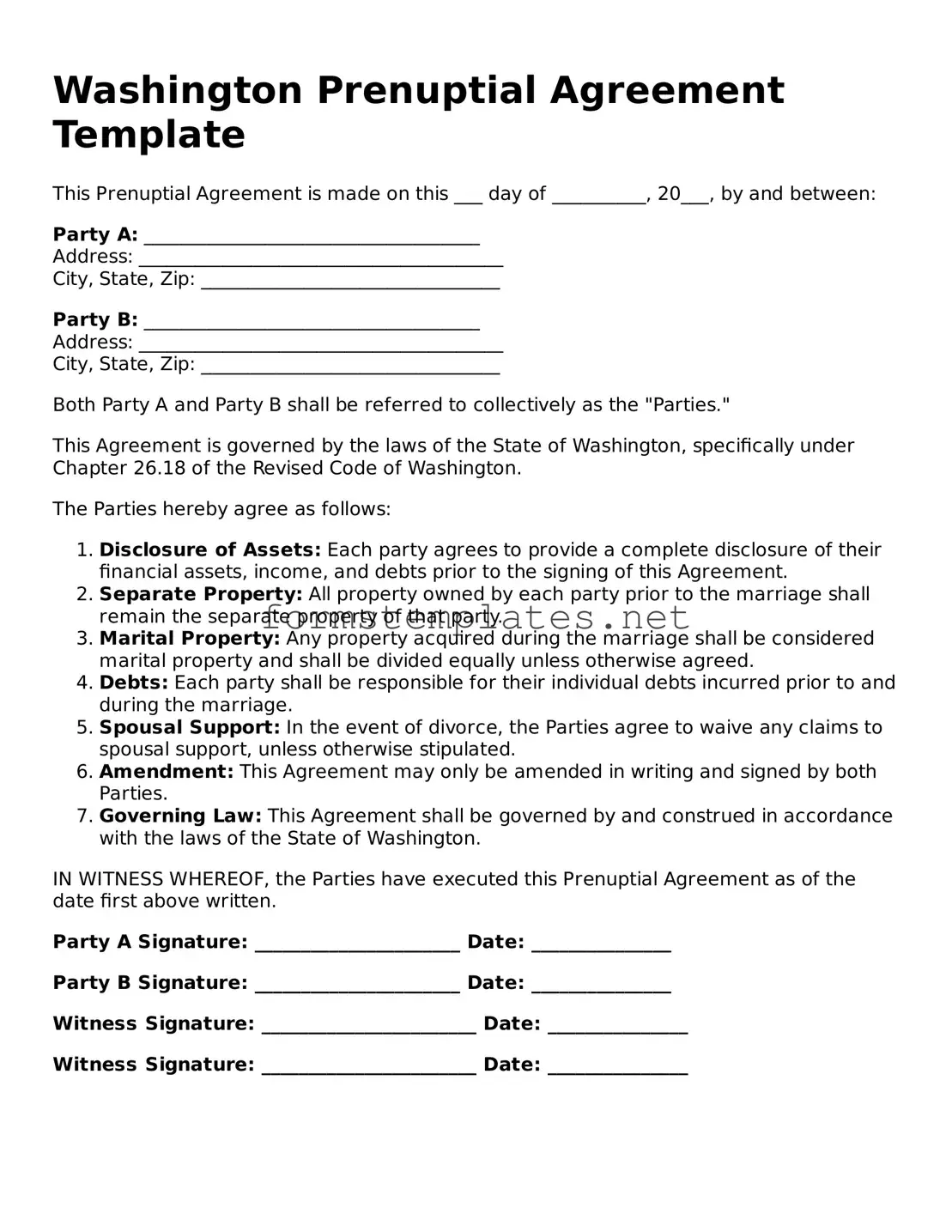

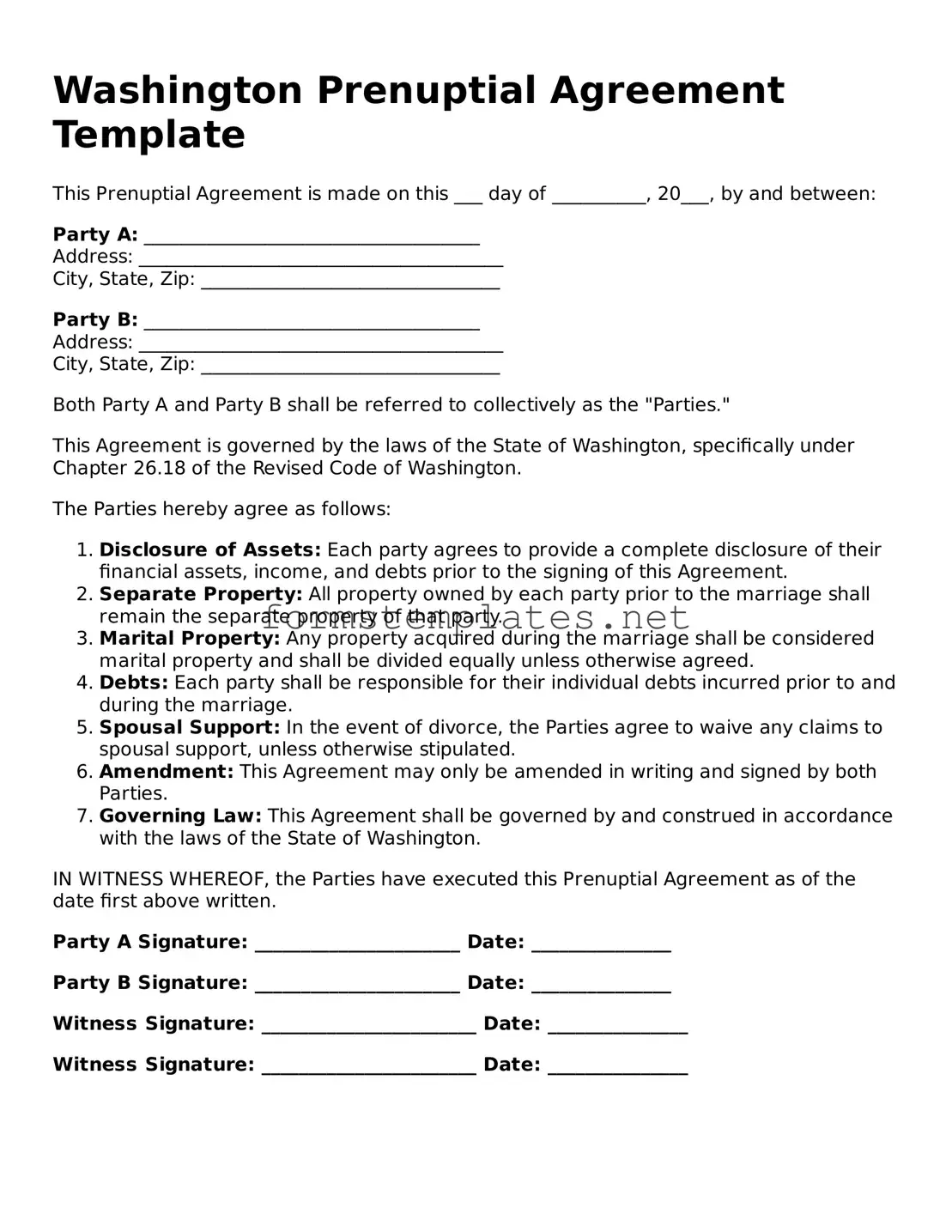

Attorney-Approved Washington Prenuptial Agreement Template

A Washington Prenuptial Agreement form is a legal document that couples can use to outline the division of assets and responsibilities in the event of a divorce or separation. This agreement helps to clarify financial expectations and protect individual interests before entering into marriage. By establishing clear terms, both parties can approach their union with a greater sense of security and understanding.

Open Editor Now

Attorney-Approved Washington Prenuptial Agreement Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Prenuptial Agreement online — simple edits, saving, and download.