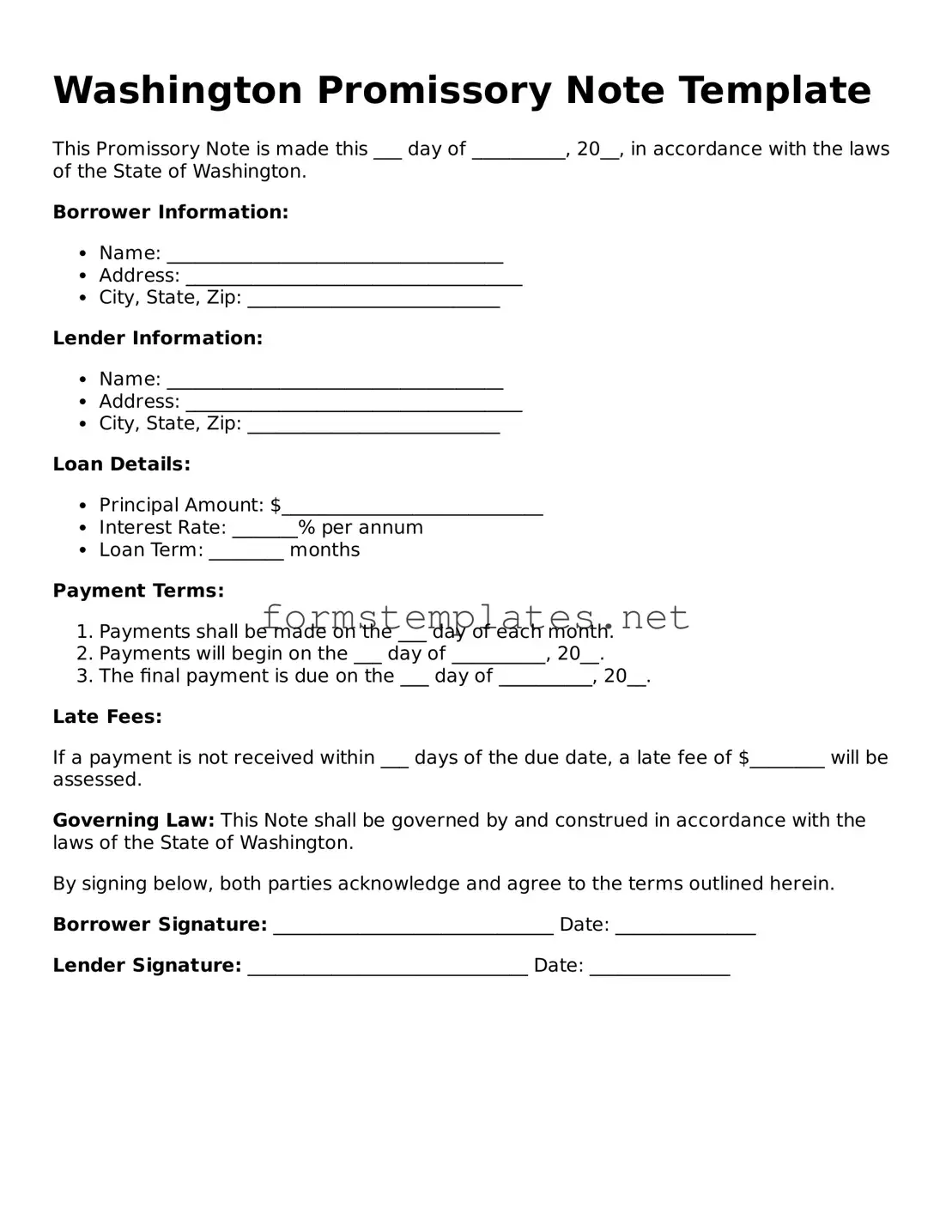

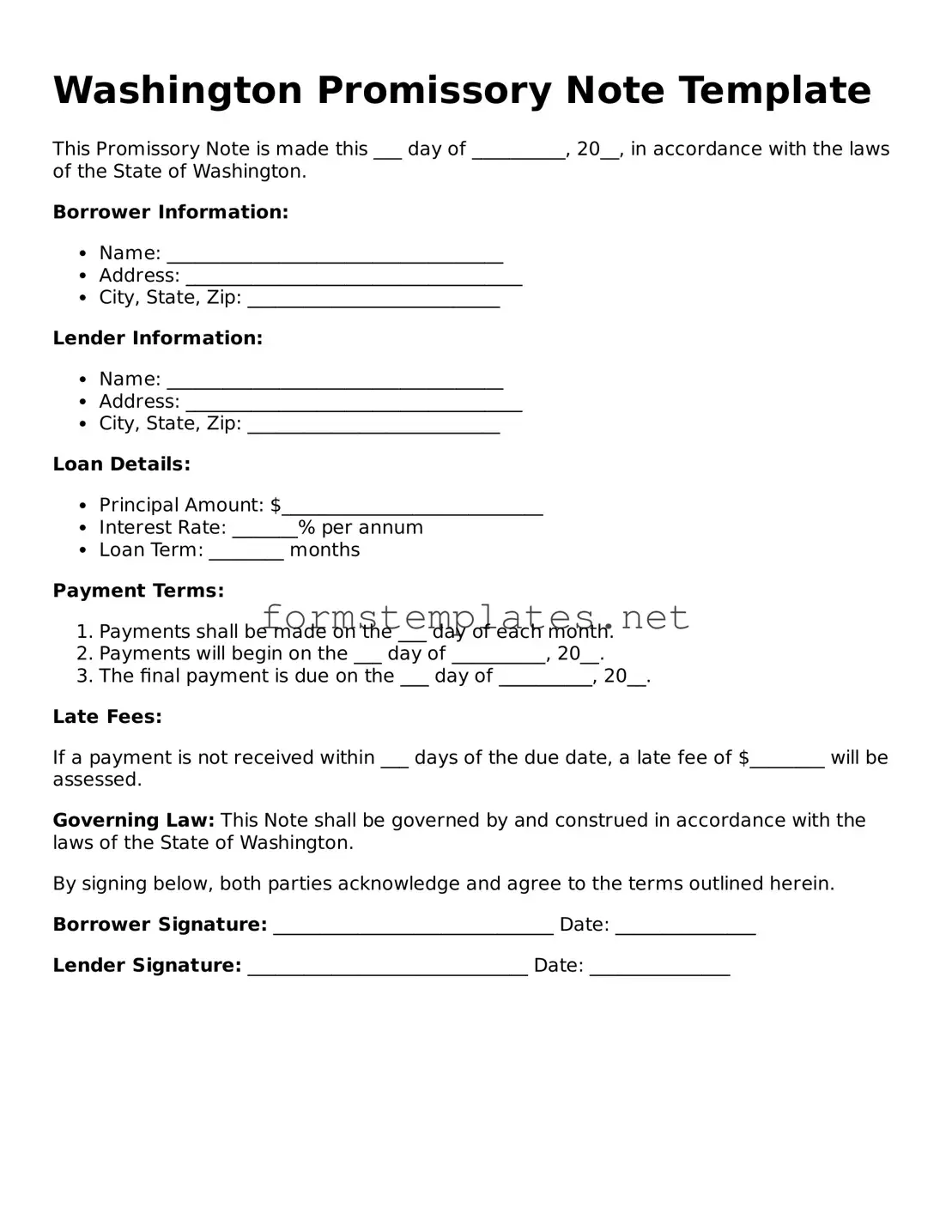

Attorney-Approved Washington Promissory Note Template

A Washington Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This form serves as a clear record of the debt, detailing the repayment schedule and any interest that may apply. Understanding this form is essential for both borrowers and lenders to ensure a smooth financial transaction.

Open Editor Now

Attorney-Approved Washington Promissory Note Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Promissory Note online — simple edits, saving, and download.