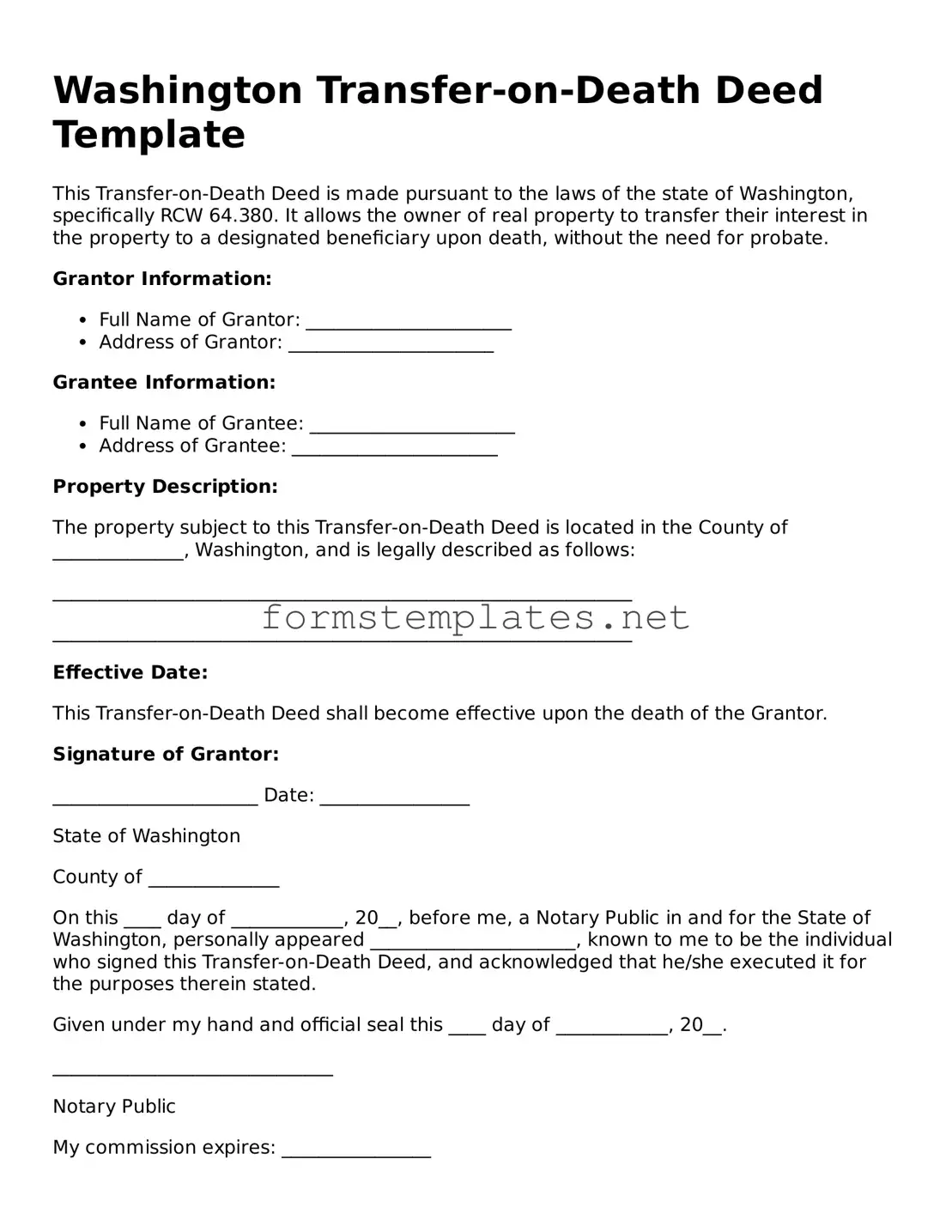

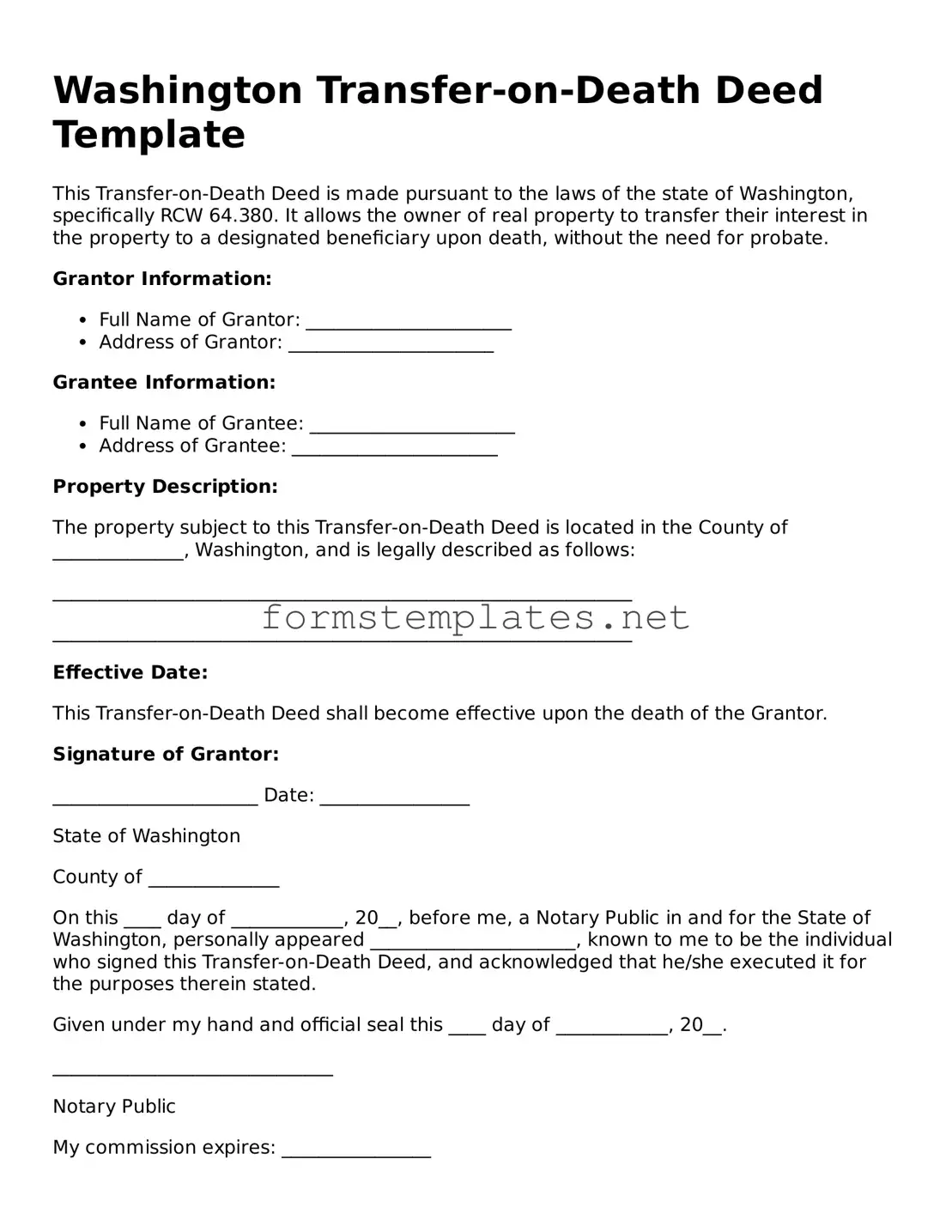

Attorney-Approved Washington Transfer-on-Death Deed Template

The Washington Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. This tool can simplify the transfer of assets and ensure that your wishes are honored. Understanding how to properly utilize this form is crucial for effective estate planning.

Open Editor Now

Attorney-Approved Washington Transfer-on-Death Deed Template

Open Editor Now

Open Editor Now

or

⇓ PDF Form

Your form still needs attention

Finalize Transfer-on-Death Deed online — simple edits, saving, and download.